UniQ Soft Technology has been a unique player in its niche market for several reasons. Its founder has more than 30 years of experience in Financial Information Systems across different business areas, spanning over 80 countries in 5 continents. More specifically, the founder worked in Banking and Financial Institutions for over 20 years, of which 17 years with Temenos Core Banking.

UniQ Soft Technology’s differential advantage is its combined skills in Financial & Management Accounting, Information System Technology, ERPs and Core Banking systems. Such a wide pool of integrated skills affords the founding team a special ability to design UniQ Financial System, a concentration of best business practices and market standard technologies.

The most prominent feature of UniQ Financial, and one that sets it apart, is that it is not a transaction-driven, but an event-driven system. While a transaction-driven accounting system captures a transaction and processes it based on a number of predefined management and accounting rules, an event-driven accounting system captures a transaction, converts it into an event, then processes this event into multiple events such as enrichment, aggregation, break-down, calculation, as needed, and then processes each of these events according to its specific nature and in line with a set of preconfigured management and accounting rules.

The fact that UniQ processes events and not transactions, provides significant flexibility when addressing various issues such as Integration, Management, Complex Accounting, and Reporting, etc.

As of today, there are several Accounting systems in the market. But none of them is specifically designed for the Financial Sector. Thus, most of these existing ERPs in the Market are built in the 70s and 80s and either geared towards meeting the needs of big and multinational companies or those of the local Small & Medium Sized Enterprises.

Financial Institutions, and more specifically banks, have built their core banking systems internally, making use of in-house resources. These systems have today proved very costly to maintain, and not flexible enough to keep pace with the economic & regulatory changes, and the increased complexity of the new financial products and instruments. Consequently, they are moving now to Packaged Core banking System which are technologically advanced, more adjusted to address temporary finance and regulatory issues. However, often these Core Banking Systems ignore the fact that a bank is a business company, where an accounting system is needed to manage such support activities as Sub-Ledgers, Human Resources, General Ledger, Cost Accounting, and Business Intelligence.

UniQ Financial is designed to complement Core Banking system, and thanks to its integrated tools, and Rule Based Accounting Engine, it is well positioned to help Banks and Financial Institutions complete their Enterprise Information Systems.

The fact UniQ Soft Team has many years of experience with Core banking at various levels gives us a competitive advantage with regard to other Accounting System Providers. On that basis, UniQ Soft can readily understand the clients’ processes and their issues, and provide them with the required solutions that leverage their core banking system in an integrated and seamless fashion.

Temenos collaborates with a network of suppliers providing solutions that are complementary to and integrated with Temenos Core banking. Leading suppliers are tightly incorporated within Temenos’ business processes, being involved and participating in different Temenos meetings and events such as TCF in order to be aligned with and updated on the latest technology changes.

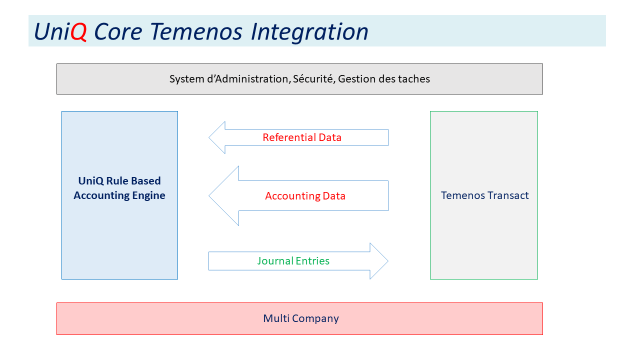

UniQ Soft Technology was one of the first solution provider to be approved as Temenos Market Place member. Since then several tools where developed by UniQ that can be used in different integrated scenarios with Temenos Transact.

The integration between UniQ Core and Core Banking Systems is very fruitful allowing financial institutions to solve complex issues by using special functions from a given UniQ Module without implementing the full module. Examples of these are Foreign Currency Position revaluation, Account Reconciliation, Contingent Bookings for Collateral, Refining Cost calculation and bookings for MIS, Foreign Currency Accounting, Interest Accrual break down into paid and not paid, Provisions calculation and Bookings, Special Tax treatments, Accounting schema adjustment, Inter- Company elimination bookings, etc. In this context, Core Banking Accounting Engine remains the main enterprise General Ledger.

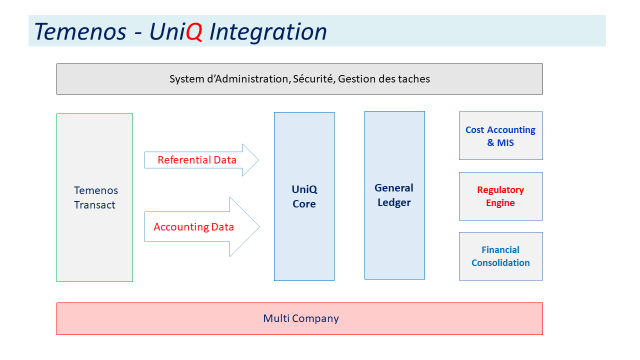

Accordingly, Core Banking covers only operation activities, and from the accounting perspective, it is a sub-leger system, as it generates all its accounting data to UniQ Core where this data is processed into UniQ General Ledger. This integration fills a crucial function in the way that Financial Institutions can drive all accounting data from different sources into a single data base. This is instrumental in avoiding all sort of manual treatments and potential errors.

UniQ Cost accounting is fully integrated with UniQ General Ledger, and it can also be integrated with market standards BI Tools.

It’s also possible to integrate UniQ Cost Accounting with Temenos Accounting Engine through UniQ Core and the various integration tools.

UniQ Regulatory Engine is fully integrated with UniQ General Ledger, and it can also be integrated with market standards BI Tools.

In addition UniQ Regultaory Engine can be integrated with other Temenos Module such as Securities, Customers, and various transaction data to complete the regulatory data base.

UniQ Financial Consolidation is fully integrated with UniQ General Ledger, and it can also be integrated with market standards BI Tools.

The consolidation data base can include integrations with all or parts of the group entities such as banks using or not Core Banking Systems, and other non-banking companies.

In this configuration Temenos Accounting Engine is used as the Enterprise General Ledger System. UniQ will provide modules such as Accounts Payables, Accounts Receivable, Fixed Assets, Inventory Management, Payroll, Human Resources, and other payment and treasury operations. These Modules can readily work with common Referential data, since Temenos Accounting Engine processes the activities independently, and then produces an accounting file into Temenos Transact.

UniQ Data Store is a Pipeline designed to collect data from Temenos Data Base (PIC) into Relational Database such as Oracle or SQL Server. This is a perfect fit create an operational database (ODS) based on a relation data based system from Temenos Standard data base with regards to its local tables, local references, multi-values and sub-values. The ODS will be available for integration with other third party systems and market standard Business Intelligence tools such as Power BI, Tableau or Click Sense. Hence allowing the bank to create report and dashboard in any easy and effective way